If you’re trying to do your PPP loan forgiveness application, your best route may be to download Form 3508EZ and Instructions to Form 3508EZ. Go through the instructions line by line. Most small businesses can use this “EZ” form instead of the original Form 3508, which is massively complicated with recursive forms. On the Instructions, there is a list of criteria for who can use Form 3508EZ.

The “Covered Period”

The first thing you need to do is figure out what Covered Period you ought to use. There are four options:

- 8 week period starting with the date you received the funds. You can use this handy tool to quickly find your Covered Period end date.

- 8 week period starting with the “Alternative Covered Period” date. You can use the Alternative Covered Period if you pay payroll biweekly or more frequently. The start date of the Alternative Covered Period is the first day of the first pay period after you received your funds. (Tip: Number crunching will be easier if your start and end dates are close to the start and end dates of a month.)

- 24 week period starting with the date you received the funds.

- 24 week period starting with the Alternative Covered Period (see Step 2).

You may submit your application before your Covered Period is up.

You may think, “Of course I’d want to opt for the 24 week period. More time to amass expenses.” But consider the fact that you have to submit scans of all the bills and the cleared checks for every expense included in your calculations. Also take into account the fact that you have to submit copies of your quarterly payroll tax returns. If you’re not in hurry, this won’t matter. But if you are under pressure to get proof of loan forgiveness, then you need to know that your quarterly tax filings won’t be available to you until the end of the month following the end of the quarter.

What this means is that if you opted for an 8 week period that included May and June, you’d have to submit quarter 2 payroll tax returns. (Quarter 2 is April, May, and June) and you would have your quarterly tax filing by the end of July, so you could submit now. If, on the other hand, you wanted to include July expenses (and use the 24 week covered period), July is in quarter 3. Quarter 3 is July, August, September. Your quarterly payroll tax filing would be available near the end of October. If you banged it out yourself, you could get it done in the beginning of October, but odds are you won’t.

So, if you qualify for the 8 week Covered Period, it would be better to use that. It’s less work.

To see if you qualify for the 8 week period, if your Covered Period or your Alternative Covered Period start dates are close to the beginning of a month, you can use your Income Statements to get an idea whether you will qualify.

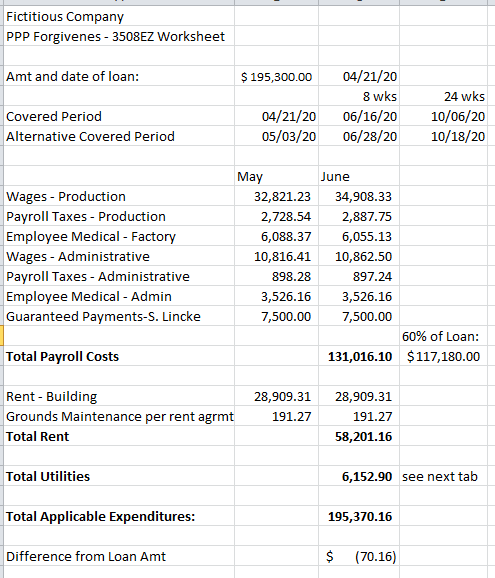

For example, say your company got its funds on April 21st. You pay biweekly, and the next payroll period after April 21st is May 3rd to May 16th. So May 3rd would be your Alternative Covered Period start date. Your end date would be June 28th. This is pretty close to the beginning and endings of months! So, you would opt for the Alternative Covered Period, and look at your May and June Income Statements (aka PnLs).

If the day you got your funds was May 1st, you would opt for that as your start date, and not use the Alternative Covered Period.

Make your own worksheet using your spreadsheet software of choice. You don’t need all the bells and whistles.

Using our example, above, with May 3rd to June 28th as our Covered Period, make a column header for May and a column header for June. Then make rows for the expense categories. Here is an example:

Depending on how your Chart of Accounts is structured, the line items on your Income Statement may be different. But here is what you can include in your PPP forgiveness application:

Payroll Costs

- Wages and salaries, capped at a rate equivalent to $100K/year (i.e. $15,385 in 8 week period)

- Payments to owners (owner-employees, self-employed, general partners (capped at a rate equivalent to $100K/year

- Health insurance costs

- Employee benefit costs such as retirement fund expenses

You can’t include Workers’ Comp expenses, which is odd because this is effectively a payroll tax

Non-payroll Costs

Note that in “Utilities” waste removal is not included, but “transportation” is allowed. As of 8/4/2020 the only definition given by the SBA is “service for the distribution of electricity, gas, water, transportation, telephone, or internet access”. Business fuel, like your fleet fuel costs, is not included.

- Phone service

- Internet service (this does not include “computer costs” such as web hosting, domain name registrations, computer service, etc.; it’s just the cost of having your internet lines, like your phone lines)

- Electric

- Gas

- Transportation utility fees paid to city or state – these are more like a tax or levy; many businesses won’t have them (see more, below)

- Rent

At this stage, you’re just doing a preliminary estimate to gauge whether you ought to choose the 8 week or the 24 week Covered Period. If you gauge wrong, it’s no big deal. You will still be able to get the job done. Just make your best estimate using your accounting software or financial reports.

Using our example, above, with May 3rd to June 28th as our Covered Period, the first thing you want to check is whether your payroll costs are likely to fall within 60% of your loan amount.

Tally up the payroll costs for May and June. As stated above, this is wages, payroll taxes, health insurance, “benefit package” benefits, and payments to owners. Is this more than your loan amount? If yes, you’re already good to move forward. If no, multiply your estimated payroll costs by 0.60. Is this amount more than your loan amount? If yes, you’re good to move forward. If no, you ought to go for the 24 week Covered Period. Then follow the rest of the steps below.

When you’re adding up payroll costs, note that there is a $100,000 cap on the amount per employee that you may include. This means that for an 8 week Covered Period, you can’t claim more than $15,385 per employee.

If your payroll costs are less than the loan amount, but more than 60%, then start adding up the other expenses for May and June. You will probably come within range of your loan amount. If your payroll costs are within 60% of your loan amount, and your total costs are more than your loan amount, proceed forward with filling out your loan forgiveness application with the 8 week Covered Period.

List of Steps to Get PPP Loan Forgiveness

- Download Form 3508EZ Paycheck Protection Program Loan Forgiveness Application

- Download Form 3508EZ Instructions

- Fill in the information at the top of the form. Get the loan numbers from your banker.

- Fill in your Covered Period dates (see above). If you are using the Alternative Covered Period, fill in both the Covered Period and the Alternative Covered Period fields

- Make a spreadsheet to tally up the costs you’ll need in the Forgiveness Amount Calculation section. Use the spreadsheet example above as a guide – the one you used for your initial estimate. Create a separate tab for the “actual” numbers.

- You need to submit a lot of documentation with your forgiveness application. If you have somebody who does your Accounts Payable, enlist their help.

- Get payroll reports of the Covered Period – the SBA says “third party payroll provider reports” or bank statements”. You need to tally up your actual payroll costs. Use the spreadsheet you made to sum up these costs. This is where it helps to have a Covered Period that starts close to the beginning of a month and ends close to the end of a month because then you could use the numbers in your financial statements if you trust that they are accurate. If not, you have to go through the payroll reports and tally up amounts that fall within the Covered Period. Use gross wages (before deductions).

- Use your spreadsheet to tally up gross wages, payroll taxes, health insurance and benefit costs, owner compensation and enter the total in Line 1 of Form 3508EZ.

- Do a check to make sure that this amount is at least 0.6 times the amount of the funds you received. If it’s not, you may want to stop and do the 24 week period.

- For the rest of the expenses, you will need scans of bills, agreements, and cleared checks. The easiest way to get the scans of the checks is to log in to your bank’s online banking platform and copy the scanned checks to an electronic file folder or document. You should keep everything in a file for each forgiveness application you’re doing. If you don’t know how to get the scans of checks, ask someone at the bank.

- If you have a business mortgage, put a copy of the amortization schedule in your electronic file.

- Get copies of cleared checks (see Step 10) or bank statements for these mortgage payments. If you opt for bank statements, you also need one for the month after your Covered Period.

- Put the amounts of mortgage interest you paid on your spreadsheet, get a total, and put the total on Line 2 of Form 3508EZ.

- For rent, you need a copy of your Lease Agreement and scans of cleared checks (see Step 10). Put the amounts on your spreadsheet, and the total on Line 3 of Form 3508EZ.

- For utilities, you need copies of the bills and scans of the cleared checks (see Step 10). Utilities do not include waste removal. You also need scans of your utility bills for February 2020 (as a comparison to pre-pandemic expenses).

- On your spreadsheet, go through each bill that was posted in the Covered Period and put the amounts on a new tab in your spreadsheet. This includes gas, electric, telephone and internet service, and “transportation utilities that are paid to the city or state”. The SBA notices don’t explain “transportation” well. You probably have a Transportation Expenses account in your Chart of Accounts, but most of these costs aren’t includable. See this article for a better explanation of transportation utilities that you can include. Put the total on Line 4 of Form 3508EZ.

- Line 5 of the Form is easy. Just total up the 1st four line and put that total on Line 5.

- On Line 6, put the amount of funds you received.

- On Line 7, take the amount you have on Line 1 and DIVIDE it by 0.60. Enter that amount on Line 7. This will be an amount that is 60% higher than your actual payroll costs.

- Now look at the amounts on Lines 5, 6, and 7. Whichever is the smallest amount, put that amount on Line 8. That’s how much of your loan is forgiven! (Hopefully.)

- Next read and initial the paragraphs that apply to you on Page 2 of Form 3508EZ. You should initial all of them in the top section. In the bottom section, you need only initial one of the two paragraphs, whichever applies to your situation.

- If just the first of the last two certifications is signed, you will need to submit documentation showing the number of employees on 1/1/2020. (See below.)

- Sign and date the bottom of Form 3508EZ.

- At this point, you’re ready to send your loan forgiveness package to your lender (the banker who gave you the PPP loan).

- Zip your files so that they will transmit. If you don’t know how to do it, ask an IT person or read about it on the web.

- You might want to ask your banker HOW they would prefer the files were submitted. Nowadays bankers like to use portals that protect sensitive information. If you don’t care about that, you could try to just send the zipped file(s) via email to your banker’s direct email address.

- Once you’ve given the files to your lender, they have to do a bunch of things with the data, and then they submit your application for forgiveness to the SBA.

- You’re still not done, though. There may be other documentation you need to get ready. See below.

Proving You Didn’t Reduce Labor

The purpose of the PPP loans was so that businesses could survive through the pandemic without firing people and cutting people’s wages too severely.

If you initialed the second to last certification on Page 2 of Form 3508EZ, you need to submit documentation showing the number of employees on Jan 1, 2020 when you apply for forgiveness, and you also need to get proof prepared to show that wages and hours weren’t reduced more than 25%.

Documents to Prepare and Store

If you reduced your payroll during your Covered Period, and the reason was due to mandated COVID-19 requirements for social distancing or sanitation, check the last paragraph on Page 2 of Form 3508EZ, and don’t check the second to last box. By doing this, you are claiming “Safe Harbor” and you may not need to furnish further documentation. You still need to keep all necessary documents, though, for six years. You could be asked at any time to give more documentation and you could be audited.

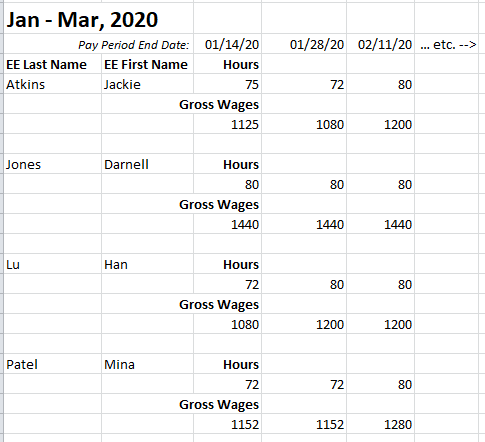

For payroll, the periods being compared are your Covered Period or Alternative Covered Period with the period January 1, 2020 to March 31, 2020. So, no matter which paragraphs you checked off, you are going to need payroll registers (reports that show each employee’s hours and gross wages) for Jan, Feb, Mar and each month in your Covered Period. Don’t submit these until asked. Just keep them in your folder with everything else PPP-related.

If you are asked for payroll reports, you might need to build a worksheet. If you aren’t asked for this, just be prepared that you may be asked at some point in the future.

When Form 3508 first came out, prior to the creation of 3508EZ, every borrower was instructed to fill out these worksheets. It was required so one could assess whether payroll costs dropped by more than the allowable rate. Now, they’ve tried to make it simpler on businesses. You probably won’t need to do these tedious worksheets, so you may want to wait until asked. But DO keep your payroll records handy.

Here is What You Need to Keep on File:

- All documentation related to your loan application

- All documentation related to your loan forgiveness application

- Payroll registers for all payrolls in Jan – Mar 2020 and in your Covered Period

- Documentation regarding any employee terminations, whether the employee was fired or they quit – keep notes and records on as much as you can

- Documentation regarding any offers of jobs that were refused

- Documentation supporting reasons why an employee’s hours were reduced

- Documentation supporting an inability to hire employees with similar qualifications to those who quit (show recruitment attempts)

- Documentation showing stay home” mandates, social distancing rules, sanitation laws, etc. (proof of your “Safe Harbor” qualification).

If You Have to Give Detailed Payroll Reports

Get out your spreadsheet again, and your payroll registers. If you have software that can export payroll data into CSV format, that would be great. If not, start moving data from the payroll reports to your spreadsheet.

Start with the “pre-pandemic” data.

Here’s an example of how you might craft your worksheet:

- Go through the payroll reports and fill in your spreadsheet. It may sound tedious, but you’ll get done faster if you enter the data period by period, and then sum it at the end.

- There is a spreadsheet put out by AICPA to help with this, but I’m not sure how helpful it is. You still have to get subtotals before you can use their spreadsheet.

- On your own spreadsheet, once you’ve filled in the wages and hours per pay period per employee, make a Sum column to the right of your data. (Excel tip: Alt+= is a handy shortcut for summing.)

- Drag the formula down, to get sums for each employee for each of their rows.

- Next get a total for the gross wages for the period, and another for the total hours. If you don’t know how to do this, ask someone who knows Excel for help.

- Do the same for your Covered Period.

- Once you have your totals, you have a few options

- Do whatever your lender, auditor, or accountant tells you to do

- Leave the sheets as is; whoever requests them may be satisfied just the way they are

- Make formulas in your spreadsheet to see if payroll dropped by more than 25% from the Jan – Mar period to your Covered Period

- Try to use the AICPA calculator (we don’t recommend this option because it will probably take a lot of time; but, if you have time, and you want to, go for it!)

What Do I Do if My Covered Period Falls Mid-Month?

If your Covered Period falls mid-month, not to worry. The only drawback will be that you can’t use your monthly Income Statement to estimate your forgiveness. You will have to assess every bill by its date. Most people will fall in this category. If your Covered Period falls close to the start and end dates of months (e.g. May 1st to June 26th), count yourself lucky! Your May and June financial reports will be a handy tool for estimating and figuring out what Covered Period to use